Real Estate Investment Trust (REIT)

Benefits of REIT REIT

| Benefits of REIT | Benefits of REIT | REIT |

|---|---|---|

| Owners may raise capital from real property that is already generating revenue and use that capital to invest and/or develop new projects. |

|

|

Relevant Codes Regarding a REIT REIT

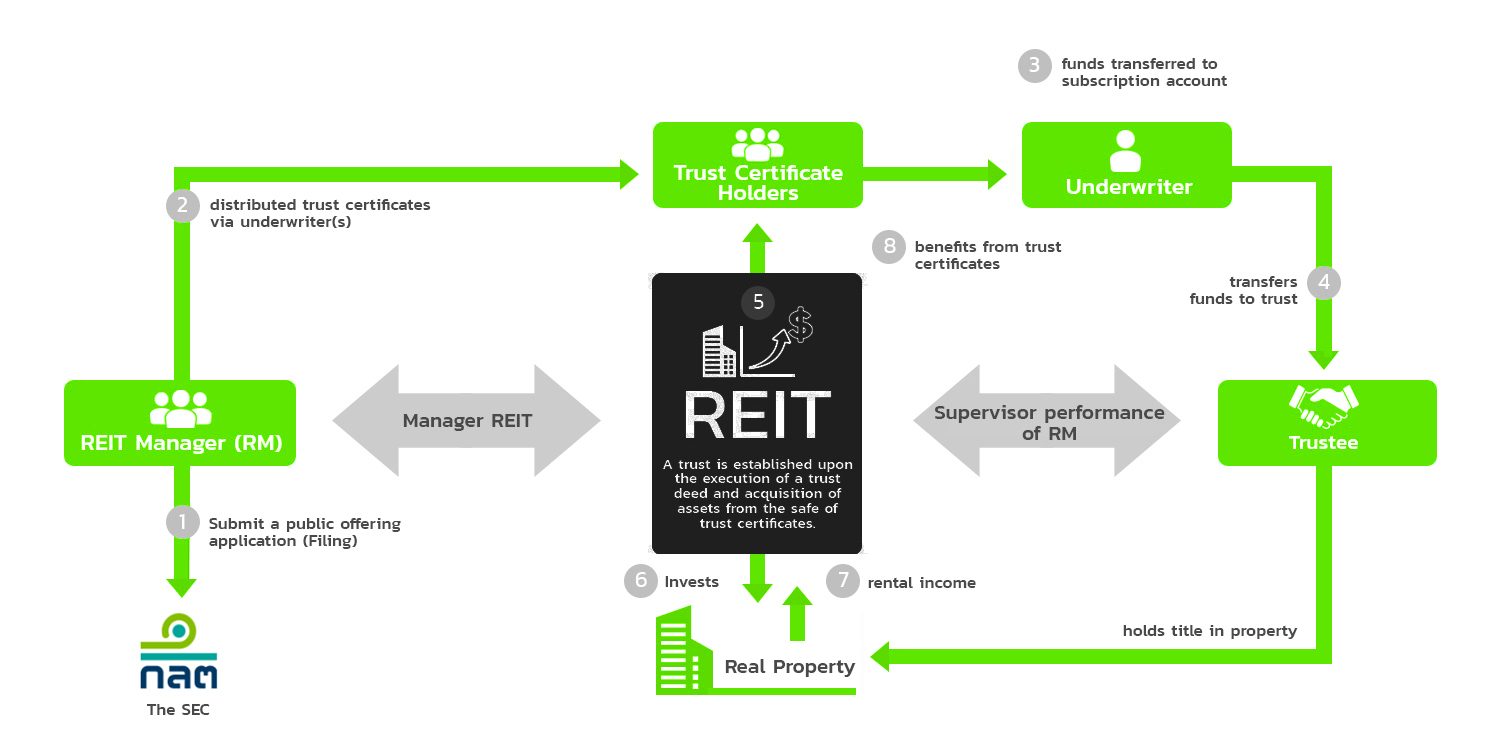

Establishing a REIT and Its Structure REIT

REIT manager (REIT manager: RM) will file a public offering of trust certificates application with the SEC. After the SEC’s approval is granted, the RM will appoint an underwriter to distribute trust certificates* to the general public. Trust Unit holders will become the REIT’s beneficiaries. After the underwriting process is complete, the underwriter will transfer capital raised (commission deducted) to the trustee to invest in real property that generates rental income on a recurring basis in order to pay dividend to trust unit holders.

- * Trust certificates are instruments which present the right of the holder as the beneficiary of the trust, represented by units; units of the same tranche have equal value (unitization).

Public Offering Application of REIT Certificates Seeking Permission to sell REIT Units.

- Trust deed or a drafted trust deed if the REIT has not yet been established;

- Underwriting of Trust Units Proposition Particulars regarding the offer for sale of trust units (Filing)

- Assessment and asset appraisal report of real estate in which the REIT will invest;

- Letter of certification from the designated trustee.

Relevant Parties REIT Manager (RM)

| Important Qualifications | Important Duties and Responsibilities |

|---|---|

|

|

Trustee

| Important Qualifications | Important Duties and Responsibilities |

|---|---|

|

|

Important Codes Regarding REIT

| Criteria | Details |

|---|---|

| Establishment | Establishment Trust deed/drafted trust deed must comply with the Trust for Transactions in Capital Market Act B.E. 2550 (2007) and relevant notifications issued by the SEC. |

| Name | Must reflect the main characteristics and investment policy of the trust |

| Size | The paid-up capital after units offering must be ≥ 500 million Baht |

| Units Transaction | REIT units must be listed on the SET. |

| Tranche | REIT units can be categorized in tranches in accordance with the prescribed rules stated in the trust deed. |

| Main Investment |

|

| Types of Investment |

The REIT may choose between two types of investment types:

|

| Nature of REIT |

|

| Leverage Limit |

|

| REIT Manager | The REIT manager must possess all required qualifications |

| Distribution and Allocation of REIT units |

|

| Unit Holding Restriction for Any Person or Group of Persons |

|

Relevant Tax

| Corporate Income Tax | Other taxes | |

|---|---|---|

| Trust | Exempt |

|

| Corporate Income Tax | Other taxes | |

|---|---|---|

| Invester |

|

|

Relevant Fees

| Item | Fee |

|---|---|

| The SEC | |

| • Application Fee | 100,000 Baht per application |

| • Filing Fee | 0.01% of all REIT units offered for sale |

|

400,000 Baht per application (Submitted between 1 Jan - 31 Dec 2019) 400,000 Baht per application (Submitted between 1 Jan - 31 Dec 2019) |

Fee Relevant to Trustee

|

Full license/limited to REIT 30,000 Baht per application |

| The SET | |

|

Similar to securities 50,000 Baht * |

| + initial listing fee | 0.05% of the paid-up capital* minimum 100,000 Baht, maximum 3,000,000 Baht |

| + annual fee |

0.035%: paid-up capital ≤ 200 million Baht 0.030%: 200 million Baht < paid-up capital ≤ 1 billion Baht 0.025%: 1 billion Baht < paid-up capital ≤ 5 billion Baht 0.020%: 5 billion Baht < paid-up capital ≤ 10 billion Baht 0.010%: paid-up capital > 10 billion Baht |

- * Application fee and initial listing fee are waived for property fund converting to REIT

Listing of a REIT

| REIT Qualifications | REIT Unit Qualifications |

|---|---|

|

Similar to the listing of securities

|

- * Under Notification of the Capital Market Supervisory Board No. TorJor. 49/2012 Re: Issuance and Offering for Sale of REIT Units for Investment in Real Property

Governance as Listed REIT

| Type of Information | Time of Disclosure | |

|---|---|---|

| Information Disclosure Based on Accounting Period |

|

Within 45 days from the last day of each quarter |

|

|

|

|

|

|

|

3 months from the end of the accounting period | |

|

120 days from the end of the accounting period | |

| Event Disclosure | Type of Information | Time of Disclosure |

|

Such as the date of the meeting of REIT unit holders, acquisition and disposition of assets / anticipated transactions with related parties, and announcement of dividend payment | Disclosed immediately |

|

Such as the change of REIT Manager, Trustee, auditor, or registrar | Within 3 business days |

|

Such as the minutes of the unit holders meeting and the report of the percentage free float | Within 14 days from the date of the event |

Maintaining Listing Status

| Free Float |

|---|

| Percentage of free float unit holders, in aggregate, is no less than 15% of the total number of units and each tranche (if any) |

ความแตกต่างระหว่าง REIT และ Property fund การลงทุนใน REIT

| Topic | Property fund | REIT |

|---|---|---|

|

||

| Legal structure | mutual fund | Trust |

| Minimum size | Not less than 500 million baht | Same |

| Number of unit holders |

Upon establishment: ≥ 250 After establishment: ≥ 35 |

the same |

| Listing of Unit | Investment units must be listed | REIT units must be listed |

| Management | Asset management company | REIT Manager, namely an asset management company or a company with expertise in managing real estate and is qualified according to the criteria set by the SEC |

| Registrar | Not required to be TSD | Requires consent of the SET |

|

||

| Type of property in which investment can be made | Only ones listed on the SEC’s positive list | Not specified; however, the real estate shall not be used by the lessee to operate immoral or illegal business |

| Investment in real estate abroad | Not permitted | Permitted |

| Development of real estate (Green-field project) | Not permitted | Not exceeding 10% of the total assets |

|

Not exceeding 10% of the net asset value (NAV) | Not exceeding 35% of the total assets and not exceeding 60% in the case REIT has received an investment grade. |

|

||

| ODistribution | At least 25% must be offered to the public, and units must be allocated to all free float subscribers equally, one board lot at a time, until all subscribed units are allocated (Small Lot First) | Not specified; allocated to free float REIT unit holders in accordance with the criteria for listing (no less than 20% of the total trust units and of each tranche (if any)) |

| Holding Restriction for Any Person or Group of Persons | No more than 1/3 of the total number of investment units | No more than 50% of the total number of REIT units and of each tranche (if any) |

|

Similar to mutual funds | Similar to listed companies |

| Annual meeting of unit holders | Not specified | Annually, within four months from the end of the fiscal year |

| Codes concerning the acquisition and disposal of assets / related parties transactions | Resolution of unit holders not required | Resolution of unit holders required for transactions of a significant size, as prescribed |

| Maintaining listing status (free float) | Not specified | Having free float unit holders holding an aggregate of not less than 15% of the total REIT units and of each tranche (if any) |

|

|

|

Investment in REIT

Considerations before investing

-

Real estate which the REIT invests in :

Investors must learn what type of real estate the REIT invests in. This will affect the returns to be received by the investors; for example, a REIT might invest in real estate abroad or real estate in a green-field project. The lessees’ ability to pay rent also affects the consistency of the income received from the particular real estate. -

Categorizing REIT units

A REIT may categorize its REIT units into tranches offered for sale to different types of investors. Investors must learn about the rights and limitations of each tranche as specified in the prospectus. -

Liquidity of trade and price uncertainty of REIT units

As REIT is required to be listed on the SET, investors may suffer risks of liquidity when trading REIT units. Moreover, the price of REIT units depends on the market conditions as well as the demand of buyers and sellers. There may be many influential factors such as economical conditions, politics, trends of real estate business, and predicted future operating results of the REIT.

For more information:

SThe Stock Exchange of Thailand New Listing - Domestic Department

Tel. 0-2229-2000 Ext. 2023, 2031

Securities and Exchange Commission Corporate Finance - Equity Product Department

Tel. 02-695-9999 Ext. 9530, 9542

+0.35%

+0.35%

-4.06%

-4.06%